Equity Group has achieved a historic milestone, becoming the first listed bank on the Nairobi Securities Exchange (NSE) to surpass a market capitalization of KSh 250 billion. This remarkable feat, recorded on Friday, October 31, 2025, follows a 9.5% surge in its share price over just two days — from KSh 60.50 to KSh 66.25 — driven by strong investor confidence and the release of record-breaking Q3 2025 financial results.

The bank’s Q3 2025 profit after tax stood at KSh 54.1 billion, surpassing its entire 2024 full-year profit of KSh 48.8 billion. This growth was underpinned by higher net interest income, robust fee and commission earnings, and disciplined cost management across regional subsidiaries, with credit quality indicators maintaining stability. The results reaffirm Equity’s position as a market leader and a benchmark for operational excellence in the banking sector.

Since listing on the NSE in 2006, Equity Group has built a legacy of consistent value creation for shareholders. Through a 2-for-1 bonus issue in 2007 and a 10-for-1 share split in 2009, the bank has significantly multiplied investor holdings — turning one original share at listing into 30 shares today. Over the years, the bank has distributed a total of KSh 39.50 per current share in dividends, translating to KSh 1,185 in cumulative dividends on an initial position, while the current market value of that same position now stands at KSh 1,987.50. Combined, this represents an impressive KSh 3,172.50 in total value created per original share.

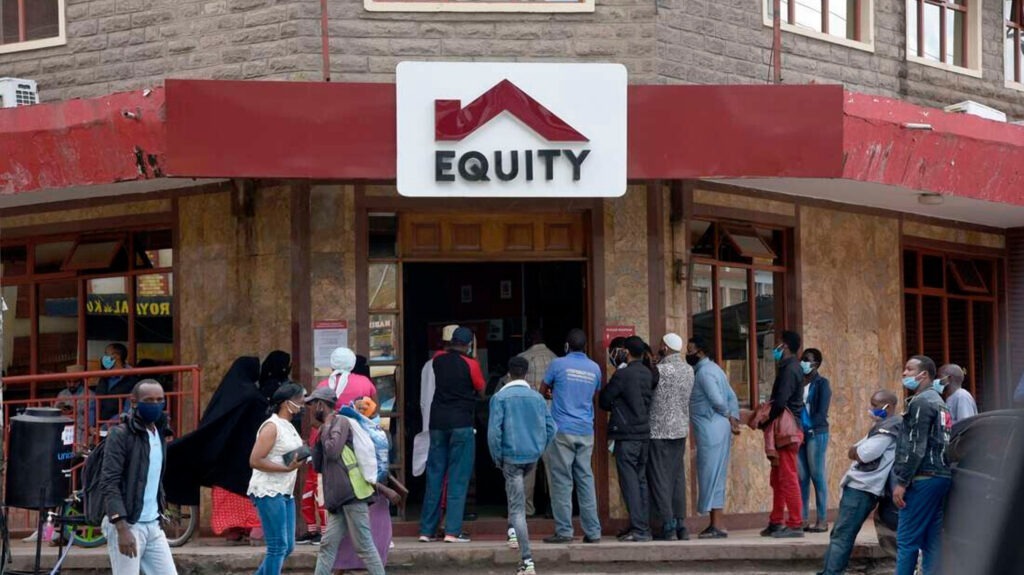

During the investor briefing, Group CEO Dr. James Mwangi attributed this milestone to the enduring strength of the Equity brand, stating that “this is not about balance sheet size; it is about brand value.” He emphasized that Equity’s success stems from trust, customer loyalty, and the ability to deliver impactful financial solutions across markets. Dr. Mwangi highlighted that people invest in the brand before they invest in the product, underscoring the intangible value Equity continues to build within the region.

With a year-to-date share price gain of 37.2%, Equity Group stands among the best-performing banking stocks in a sector-wide rally that has seen peers like NCBA and KCB also post significant growth. As the region’s most valuable banking brand, Equity’s achievement marks not just a financial milestone, but a testament to strategic leadership, innovation, and resilience in a dynamic market environment.